This is the second part to my two-post series about starting an LLC. In Part 1, I talked about the pros and cons of starting your own business. Part 2 will walk you through exactly what you need to know before you apply.

So what are the details behind starting an LLC for your small business? If you’re following along step-by-step, all you’ll have to do by the end of this post is wait for your paperwork to come back! Here’s an overview of today’s steps:

- Set up a business address for your LLC.

- Finalize your company’s name.

- Apply for a Federal Tax ID Number—AKA an EIN (Employer Identification Number).

- Determine your registered agent (no, not a 007-type agent, cool as that would be).

- Decide how your LLC will be run.

- Solidify your LLC’s percentages of ownership (if run by more than one owner).

- Consider how you want your LLC to be taxed.

Disclaimer: I am not a lawyer, CPA or any kind of professional. I simply share my own experiences about how I did things, and the actions you take based on what I say is not my responsibility. As always, you should seek advice from a trusted professional before making these types of decisions. Thanks!

If you’re looking for some free legal advice as applies to online business, Session 231 of the Smart Passive Income Podcast is a great place to start. Be sure to scroll to the end of this post for a couple of FAQs regarding LLCs, which will help you decide if you should incorporate. Incorporating as an LLC is one of the most important decisions you can make to protect your blog and the future of your business. Make sure you take the time to thoroughly understand everything, and don’t be afraid to “press pause” so you can get clarification.

Let’s dig in!

How to Set Up a Business Address for Your LLC

Before you apply for any kind of business structure, whether it’s an LLC or a Corporation, you’re going to need a physical business address.

You should not use your home address.

Why?

Because you want to keep your business and personal activities as separate as possible. There could be consequences involved by mixing the two together. This is exactly the reason why you should also create a business banking account after you receive your paperwork from the state.

So what can you do?

You basically have two options:

- Lease a physical office with an address.

- Get a mailbox at a local UPS Store (or equivalent).

#1 is not really an option for most of us who are just working from home on the internet. The best thing you can do to get your business address is to rent a mailbox from a local UPS Store, or any other type of place that has mailboxes, except the Post Office.

When submitting your application for your business, you’re not allowed to use a P.O. Box number. However, when you rent from a UPS store, you can simply turn your mailbox number into a “Suite” number, and the address will totally fly. In fact, that’s what was recommended to me by the person working at the UPS Store.

So, if I ended up getting mailbox #111 from a UPS Store on 222 Main Street, my physical business address might look like this:

222 Main Street, Suite 111

Alternatively, you could use #111, Unit 111, STE 111—it’s up to you. I like to use Suite because it sounds pretty awesome.

Renting out the smallest mailbox for six months will cost you about $147.00. You could get a better deal (per month) if you go with a longer contract.

Also, make sure to bring two forms of identification, which is required to get a mailbox—at least from the UPS Store.

What You Need to Know for Your LLC

In this section, I’ll take you through the kinds of questions you’re going to have to answer as you sign up for your LLC, specifically through LegalZoom; however you’ll need to know these things anyways if you decide to file on your own or hire a lawyer to do it for you. [Full Disclosure: As an affiliate, I receive compensation if you purchase through this link.]

Here’s a full walkthrough of how I used LegalZoom to create my LLC in just thirty minutes.

The Name of Your Company

First, you’ll have to come up with a name for your company. The name is totally up to you, however there are a few restrictions that I’ll quickly note for you here:

- The name of your company must end with “limited liability company”, “LLC”, or “L.L.C.” (Mine is Flynndustries, LLC.)

- It must not contain the words “bank,” “trust,” “trustee,””incorporated,” “inc.,” corporation,” or “corp.,” “insurer” or “insurance company” or any other words suggesting that it is in the business of issuing policies of insurance and assuming insurance risks.

- It cannot be the same (or almost the same) as any other reserved or registered LLC.

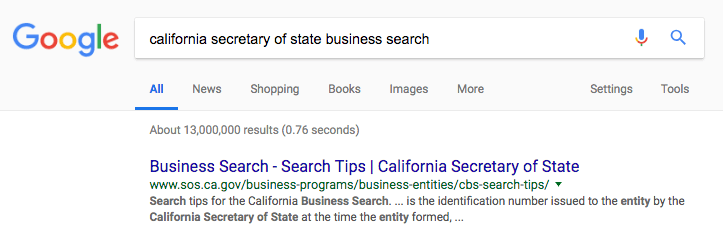

That last one is a biggy. In order to see if the name of your company (or one similar to it) has already been used, you’ll have to check with your Secretary of State records. To do this, simply type in the following into a Google Search field:

“name of state” secretary of state business name search

Example:

Conveniently, if you file through LegalZoom, they will do this check for you. You can enter two alternate business names just in case your first choice has already been taken or looks similar to an existing business name. [Full Disclosure: As an affiliate, I receive compensation if you purchase through this link.]

The Federal Tax Identification Number

The Federal Tax ID Number, also known as an EIN (Employer Identification Number), is basically the equivalent of a social security number for your business. You’ll be asked by LegalZoom whether or not you would like them to help your LLC apply for an EIN.

You absolutely need the EIN in order to create your business, obtain your business banking account, and get paid. You have the option of having LegalZoom apply for one for you (for a fee), or simply have them prepare the IRS forms for you (for a smaller fee), so you can send them off yourself.

Update: You can also apply for your EIN online through the IRS website. It’s relatively simple and you get your EIN almost immediately.

Thanks to Jay Thrash, a commenter below, for this helpful tip.

Who Will Be Your Registered Agent?

Most states require that any business entity must designate and maintain a “Registered Agent.”

A registered agent is the person designated to accept official documentation if the LLC is “served” with a lawsuit.

The agent must either be:

- An adult living in the same state that you formed your business in (again, P.O. boxes are not acceptable), or

- A company registered with the Secretary of State in the same state that you formed your business in.

If you form your LLC in your home state, any one of it’s members could become the registered agent for the company. That being said, there are some advantages to having another person or company act as your registered agent:

- First, it adds an extra layer of privacy, (since the registered agent’s name and contact information are publicly available), and;

- Secondly, this ensures if your LLC is named in a lawsuit, no one will surprise you at home on a Sunday night with court papers, which would totally suck.

I understand that much of this is probably new to you and it’s a lot to think about, but that’s why I’m here. There’s more, so let’s keep going!

How Will Your LLC Be Run?

Before we move any further, understand this terminology related to LLCs: A “member” is the same as an owner of the LLC. There may be more than one.

If the LLC is managed by its members, then its owners are responsible for running the company.

If the LLC has a specific manager, then the appointed manager (who doesn’t necessarily have to be a member), is responsible for running the company, not the members.

For those of you who are going at it alone, you’ll simple have one member (you), and the company will be managed by its single member (you again).

If you’re confused by any of this, don’t worry. Again, LegalZoom does a great job of explaining everything (which is how I learned all of this, by going through it several times myself!), and personally it justified the slightly higher fees than simply filing for the LLC on your own.

Capital Contribution and Percentage of Ownership

If you’re a single member LLC, this part is easy. You simply enter how much you’re going to initially contribute to the company, as well as the percentage of ownership, which is 100 percent.

If you have other members, then this becomes a little more challenging. Hopefully, you and your partner(s) have spent time talking about percentages of ownership and how much each of you are contributing to the company.

This will have an impact on how you share your profits, so if you haven’t already done so, be sure to work things out (civilly) with your business partners before you get to this point. If you’re looking for guidance in that department, read the Dos and Don’ts Guide to Finding Business Partners, a guest post by my attorney, Richard A. Chapo of SoCalInternetLawyer.com.

How Do You Want Your LLC to Be Taxed

You have two options here.

You can be taxed as a pass-through entity such as a partnership or sole proprietorship, or, you can be taxed as a corporation.

If you choose to be taxed as a partnership (for multi member LLCs) or sole proprietorship (for single member LLCs), then the LLC itself does not pay taxes and does not have a tax return. The LLC owner(s) report business losses or profits on their personal tax returns.

If you elect to be taxed as a corporation, then you may go through what’s called “double taxation,” meaning the profits of your corporate first get taxed at the corporate level, and then again on your personal tax returns.

There is some additional paperwork needed to fill out (provided by LegalZoom), if you do choose to be taxed as a corporation.

How Long Will You Have to Wait Before You Actually Become a Business Entity?

After you answer a few other questions and submit your application to LegalZoom, who will then process the information you provide to the state, you’re looking at an average of 20-35 days before you get any type of paperwork back from the state, which includes your EIN, your Articles of Organization and Operating Agreement, which are all required by most banks in order to get a business bank account.

When I helped my friend start his own business the other day, LegalZoom said that the Secretary of the State (this is in California), was actually back logged with new business applications, so there would be a bit of a delay. I don’t know if that’s a good thing (because new businesses are starting up), or a bad thing (because there just isn’t enough personnel or effort into helping Californians start their own business), but either way, it’s going to take awhile before we hear back. Wait time will obviously vary between states, but it won’t happen overnight.

How Much Will It Cost You?

Well, the answer depends on which options you choose on LegalZoom. [Full Disclosure: As an affiliate, I receive compensation if you purchase through this link.]

LegalZoom has three different packages: the Economy Package, the Standard Package, and the Express Gold. You can view exactly what is included with each package here, but all you really need to officially start your business is the cheapest package, the Economy Package, which costs $79.00 + any state fees.

When I started my first company, I was really excited so I decided to go all out and purchase the Express Gold package. It was pretty cool because I got a nice looking folder with my company name embossed on it, a seal stamp, and a CD-rom with a bunch of business and legal forms, but honestly none of that stuff is required, and I’ve never used most of that stuff.

With the Economy package—the Federal Tax ID number, the Registered Agent service, and fees for the state of California—the total comes to just over $500.00.

No, that’s not cheap. And yes, you could probably get it done for less money by doing it on your own. However, I feel that the price is fair because of the education I received while I was filling out the application, as well as the excellent customer service and help that LegalZoom provides for us new business owners.

That’s just me though, and exactly how you proceed is totally up to you. I’m just simply sharing my own experiences hoping that you’ll learn from them in one way or another. As always, you should seek professional advice before making any business decisions regarding the formation of your company.

Have Questions?

I’ve had a lot of questions about LLCs, which comes as no surprise considering how big a step forming one is. That’s why I recommend hiring professionals to help you through the process (like the fine folks over at LegalZoom). Here are a few episodes of my podcast, AskPat, where I’ve gotten questions about LLCs. These questions aren’t unique to the podcast though, I’ve heard them countless times. Maybe you’ve had similar questions—I hope my answers help!

AP 0329: When Do I Need to Set Up an LLC?

There are a number of reasons for incorporating yourself, but the biggest reason is to protect yourself. And so you have to be careful. Your personal assets would be at risk if you are not protected. And that’s the big thing. When you are protected under an LLC you have to make sure that you separate everything personal from business. So you can’t pay for personal things with your business account and vice versa.

LLC is just one business type that you can incorporate into. There’s S Corp, C Corp, and all these other things. You want to make sure that you get some help and figure out what’s best for you.

AP 0056: When Do I Turn My Blog or Niche Site into a Business Entity? When Do I Trademark?

How do you know it’s the right time? Well, for me, I knew it was the right time when I started making money. But I also knew it was the right time when—and this is the part that is going to be confusing for people—I knew that I needed to protect myself and my personal assets. That’s the benefit, that’s the real reason why you’d want to create a business. I mean, there’s many benefits to doing so, like, you can write off lot of your things for tax purposes and things like that. You become, sort of, more professional and authoritative when you’re known as a business, and you’re not just a sole proprietor.

But really, you create that business entity so it, itself, becomes almost like its own person. If somebody were to sue you, for example, through your business, they would sue your business. They wouldn’t sue you. If you do a good job of keeping your personal assets separate from your business assets, they can’t touch your personal stuff.

AP 0787: If I Have Multiple Businesses, Do They Need Separate LLCs?

Let me go through the history of my business structures, and kind of my thinking behind all of it, and the recommendations that I’ve gotten and stuff. Now, obviously, your situation may be different than mine, and you definitely want to consult with an expert, you know, an attorney or somebody who can help you with managing your structures in the way that is best for you. You know, depending what state you’re in, you may want to make different decisions.

In Closing

I hope this two post series about forming an LLC has helped some of you as you begin to take what you do online to a whole new level in 2010.

Lastly, to all of you non-US readers, I know these last two posts do not really apply to you, but hopefully you can get a glimpse as to how these kinds of things work in the U.S. If any of you have any similar posts or resources for starting businesses in other countries, please feel free to share, as I’m sure other people are as curious as me.

Thanks everyone, and I’m wishing you all the best.

Cheers!

John Corcoran

John Corcoran Richard A. Chapo

Richard A. Chapo